Crypto AI Revolution Megathread

+ My Top Picks

How DePIN is helping meet the need for AI & compute in the age of the exponential

Hello.

In this article I will touch on:

The current AI landscape, Growth trajectory

Demand pressures put on existing infrastructure due to AI

The need for decentralized alternatives

Market trends and imbalances leading to opportunities

The Global liquidity cycle

Deep dive into promising DePIN players

My Top Picks

Wisdom

1 trade can set you up for life or ruin your life.

Before we dive head first into this article, I’d like to include a small bit of wisdom for my readers on the delicate balance between luck and risk, as well as the role of greed, fear and prudence in our market decisions and personal goal setting.

Often the only difference between an astute financial decision and a foolish and reckless one is a single variable going in our favor, in hindsight. Taking on a trade or investment necessarily comes with it some degree of risk or uncertainty - Life is filled with an unmeasurable amount of happenstance, so many in fact it’s impossible to account for it all. What this means is nothing is a 100% certainty, and that’s ok - some of the most successful investors and traders of all time could have been viewed much differently had their trades worked out in the opposite.

1 successful trade, instead of life changing in the positive, could absolutely destroy you if it went against. Plan for this possibility mentally, and build the fortitude to not let the potential risk deter you from your goals. This doesn’t mean throw risk management out the window, it means enter all investment decisions with the mindset of ‘What is my downside’ vs ‘What is my upside’, and be okay living with either outcome, knowing full well as soon as you undertake it many twists and turns are fully out of your control.

Learn to accept positive and negative outcomes, not every idea will work out, and it doesn’t mean it’s your fault - life is complex.

Learn to love the game and live with the risk.

Learn to know when enough is enough.

The new reality of a primarily AI-driven economy

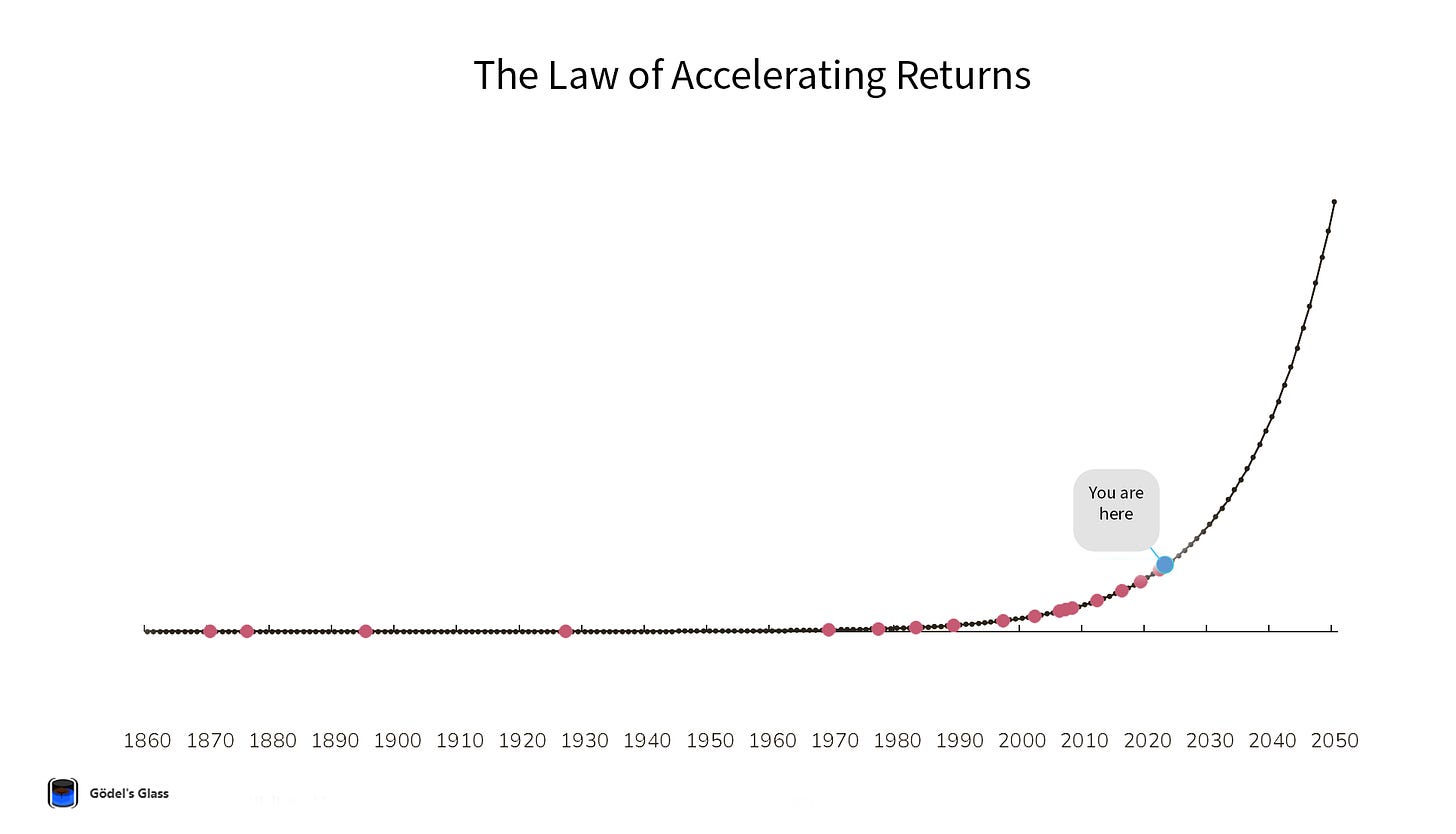

People think in the linear.

Technology grows in the exponential.

When speaking of AI and technological progress broadly, it’s beneficial to first address our perception of it. Humans tend to think in the linear, whereas technology progresses (grows) in the exponential. This is important to define as it shapes all of the things we see around us - from the computer we communicate daily from, to the monitors we read them from, the wireless signals they transmit all around us, etc.

Exponential growth dictates and predicts demand forces for the ‘currency’ of technology (see: GPUs, data, chips, etc); When we begin understand it, we then understand the ever greater need for the requisite power & infrastrcuture to support it.

In accordance with exponential growth, organizations and people within will need to find creative ways to control costs to achieving continued AI growth and compute, as well as improved efficiencies toward - enter DePIN.

The Law of Accelerating Returns

Proposed by noted computer scientist, author, inventor, and futurist Ray Kurzweil, the Law of Accelerating Returns suggests that technological change is exponential rather than linear.

It can best be described as an evolutionary process that applies positive feedback on itself, resulting in more capable methods over time due to the fact that prior stages of progress are used to create the next stage. Each stage in this evolutionary process naturally progresses more rapidly by building on the products of the previous stage.

Put in simple terms, technology begets better technology, roughly doubling in capability every ~10 years. This is the main factor behind the explosion in AI capability, as well as compute demand required to power all of it (such as LLMs, GPUs, etc).

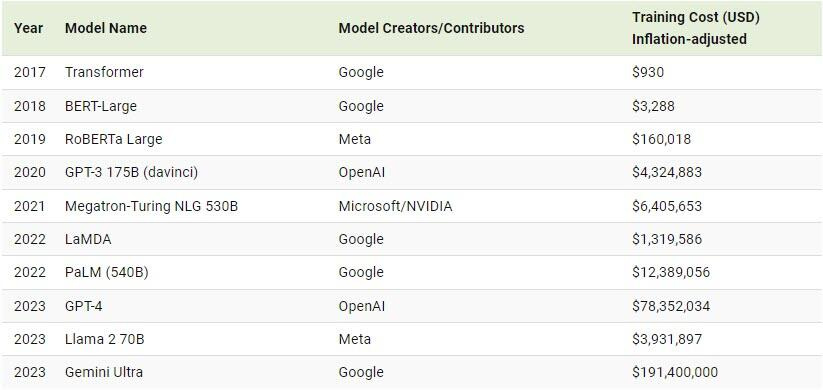

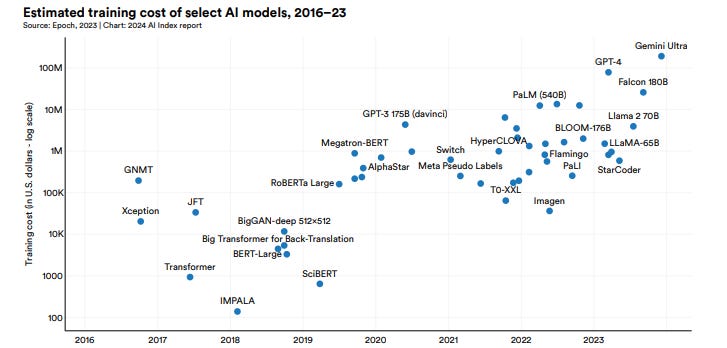

AI training costs have ballooned over time..

Advanced AI models such as OpenAI’s ChatGPT and Gemini Ultra from Google require millions of dollars of capital to run, with costs escalating all the time with each successive iteration.

Standford University’s 2024 Report on Artificial Intelligence has further documented the rising training costs for advanced AI models.

As compute demands continue to increase in the years to come, expenses for the power and infrastructure necessary to run them continue to rise. In response to this demand for computational horsepower, organizations are reconsidering their approach to training generative AI models.

Approaches being considered include creating smaller models with more exact parameters and specificity (single tasks vs broad). Other still are experimenting with creating their own in-house synthetic data to feed into AI systems - a clear breakthrough is yet to be seen with these approaches.

Training Future AI Models - Incentivized Distributed Models as a natural fit

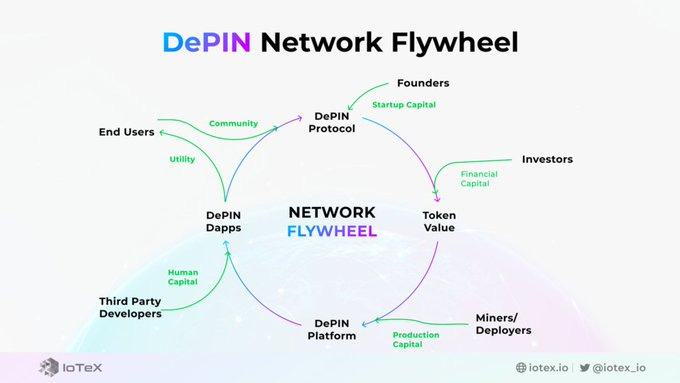

DePIN leveraging GPUs and a Cloud model are well suited for future scenarios of exponential compute growth expansion as well as the need for better efficiencies to control costs, due to the unique incentivization structures inherent within them. This can be seen in the ‘DePIN Network Flywheel’, which rewards and incentivizes network participants within to contribute to its growth, from users, developers, founders, investors, and miners/deployers.

If ‘GPU compute’ is the new Oil, then ‘Crypto / DePIN’ is the drill, as it is simply a model that enables more compute-ability organically than would have otherwise been possible via a single centralized model.

With the exponential growth in technology, AI, and demands firmly in our minds, along with a grasp of DePIN as a solution to meet this need from an infrastructure and compute perspective, lets take a look at the market side of the equation, which will help us envision possible ways to take advantage.

Market Opportunity and The Global Liquidity Cycle

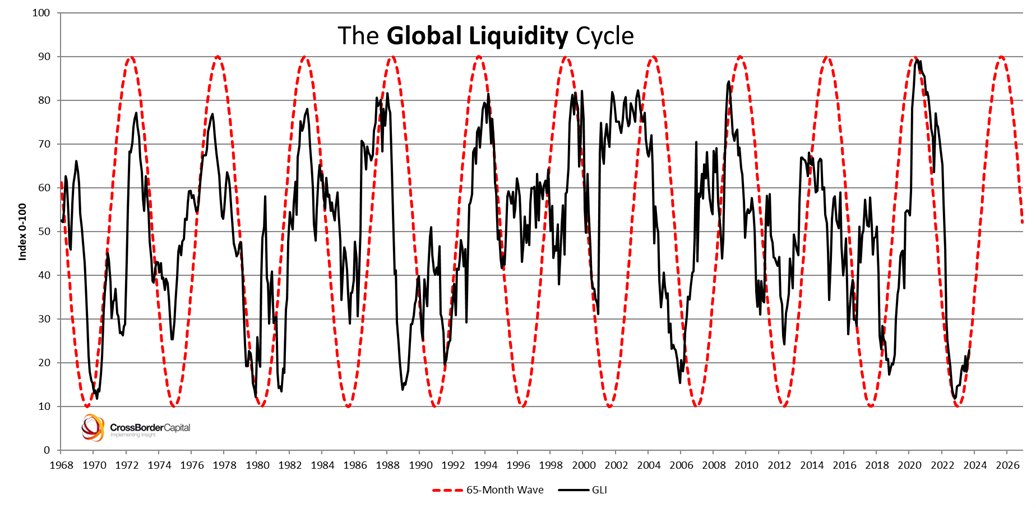

Perhaps one of the most reliable indicators as far as a measuring an opportune environment for investing in risk assets is liquidity, and one of the best ways to measure liquidity is via the global liquidity cycle.

According to Michael Howell of Capital Wars, Global Liquidity is a US$170 trillion dollar funding pool measured through taking sources of funds from the assets-side of private sector balance sheets, and comprises the short-term liabilities of credit providers (see banks & shadow banks). Also included are cash flows, households and corporations.

The global liquidity cycle runs in a ‘sine wave’, or repeating wave, on a average duration of 65 months (or about 5-6 years) with some degree of reliability. At current trajectory, the cycle of global liquidity is currently trending up, and will meet its apex at or around the year end of 2025. This is important as liquidity is the fuel necessary to ‘feed’ ever higher asset valuations. The debt based global environment in which we currently live requires positive liquidity inflows in order to sustain itself.

The Global liquidity cycle is one reason why I believe we are far from done with this bull cycle, with many other positive factors such as politics in the west influencing sentiment into year end/2025, positive seasonality, continued demand pressures from BTC ETFs, added effects of ETH ETFs, speculation from next-in-line altcoin ETFs (see SOL, LINK, BEAM), as well as the current place in the long term growth trend of BTC & crypto capitalization pointing to higher valuations ahead in the next 1 - 1.5yrs.

NVDA vs. ‘Crypto AI’

Nvidia, an ‘AI’ stock in the NASDAQ now makes up about ~80% of the market for AI chips used in data centers, a business that derives its demand from organizations such as OpenAI, Microsoft, Alphabet , Amazon , Meta and others. These tech hungry firms have rushed to snap up Nvidia’s processors as their AI models continue to demand them due to their increasingly large workloads.

This demand for chips to power AI applications has reflected in Nvidia’s stock ($NVDA), which has been on a tear in recent times.

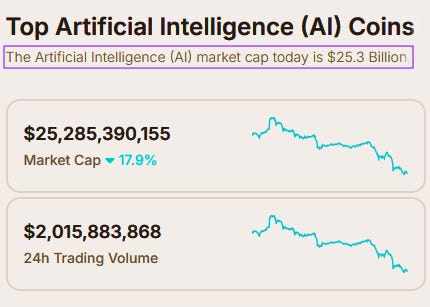

$NVDA, 1 stock, is now worth 3.33 Trillion$ (with a ‘T’).

All of AI-Crypto (cloud, DePIN, GPU etc) currently totals only around 25.3 Billion$ (with a ‘B’).

3.33 Trillion is 131x the size of 25.3 Billion. Put another way, 1 ‘AI’ stock is now worth over 100x the entire market for crypto AI currently.

Market opportunities in the AI / DePIN space exist due to valuation inefficiencies such as these between traditional markets and crypto; My thesis is predicated on these inefficiencies getting filled as capital seeks a home from overvalued to undervalued.

In addition to the AI / DePIN sector, I believe the gaming market will also continue to evolve to encompass more and more web3, with ‘web3’ simply merging or absorbing into it over time. Gaming and AI / DePIN form my 2 favorite narratives to invest in the crypto market due to being both future growth heavy as well as undervalued / immature vs overvalued / traditional bets.

With that said, lets take a look at some players we can use to gain exposure.

Project Analysis, Thoughts & Picks

RENDER ($RNDR) ✨

A decentralized global network connecting artists and professionals to GPUs and AI GPUs at scale

💎 Sector: Compute Network

💎 Ticker: $RNDR

👉 Do I own it?: NoRender Network is a leading provider of decentralized, GPU based rendering solutions which seeks to disrupt the digital creation space.

Node operators can opt to monetize idle GPU power via the cloud, effectively connecting compute power to artists looking to render large compute-intensive 3D modeling workloads.

📌 Market Outlook

I view Render as a relatively ‘safer’ bet in the AI / GPU space, due to its comparatively higher market cap. Its chart has recently sold off into a prior key support level, so could be an interesting longer term play for those looking to gain exposure to this sector.

📌 $RNDR Market Snapshot (as of 6/18/24)

Price: ~7.18$

Current supply: ~388m

Total supply: ~532m

Mkt cap / FDV: 2.78b$ / 3.81b$

AKASH ($AKT) ✨

Sovereign infrastructure 'Supercloud' providing permissionless access to cloud resources at scale

💎 Sector: Compute Network

💎 Ticker: $AKT

👉 Do I own it?: NoAkash is another player in the race for Compute - it’s a network seeking to reduce the hardware crunch caused by crowdsourced GPU power.

Billed as an ‘Airbnb for server hosting’, it serves many applications with various use cases such as machine learning, website hosting, blockchain nodes, as well as video game servers, at an impressive ~15% of the cost of competitors such as Microsoft Azure, Google Cloud, and Amazon Web Services. Users can also elect to buy and sell cloud storage on their marketplace seamlessly.

📌 $AKT Market Snapshot (as of 6/18/24)

Price: ~2.65$

Current supply: ~240m

Total supply: ~241m

Mkt cap / FDV: 635m$ / 637m$

ATOR PROTOCOL ($ATOR) ✨

DePIN Privacy via an anonymous and scalable onion-based network, hardware systems and incentivized DeFI

💎 Sector: Privacy/DePIN

💎 Ticker: $ATOR

👉 Do I own it?: No📌 The Growing need for Private networks in an increasingly connected world

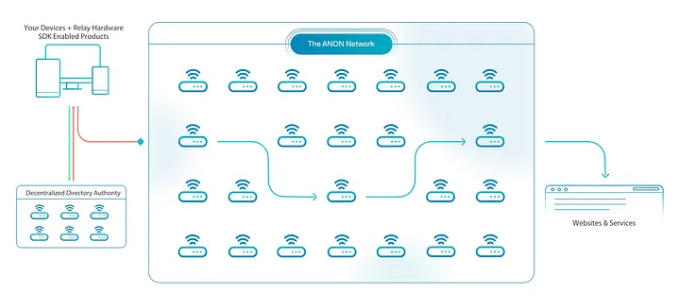

ATOR can best be described as a private DePIN. By utilizing hardware systems (relays) and an anonymous onion-based network (The ANON Network), it seeks to be an alternative to public networks vulnerable to data leak and coercion.

While decentralized networks have many benefits, a glaring downside might be that they are too open and transparent, allowing those with mal-intent an open attack vector vs more closed systems. ATOR seeks to combine the benefit of a decentralized approach with the benefits of private networks.

By blending the two, anonymity can be preserved, while reaping the benefits of DePIN and DeFI for all network participants. It’s goals are lofty - to build a global anonymous routing network - so upside could be as well if it pulls it off.

📌 Market Outlook

ATOR is a lower market cap than many of the other AI plays on this list. You can view this one of two ways: More upside, but also more risk. The chart has sold off from touching a high around ~4$, and is now testing support around the ~1.30$ level.

The chart moves quickly, so be sure you can stomach the volatility for potentially more upside.

📌 $ATOR Market Snapshot (as of 6/18/24)

Price: 1.37$

Current supply: ~73.2m

Total supply: ~100m

Mkt cap / FDV: 100.4m$ / 137.1m$

IONET ($IO) ✨

Unleashing Global GPU Power via AI Compute-as-a-Currency & the Internet of GPUs

💎 Sector: Compute Network

💎 Ticker: $IO

👉 Do I own it?: YesIo.net, or $IO, can best be described as ‘AI Compute-as-a-Currency’. Built on Solana, it is forming the Internet of GPUs. IO aims to unleash Global GPU Power via AI Compute-as-a-Currency and the Internet of GPUs

📌 Strategic Collaboration with Aethir

Io.net and Aethir have announced a strategic collaboration with the goal of enhancing GPU access for AI, machine learning applications and well as gaming. This partnership will also integrate virtualization technology from IO along with Aethir’s enterprise grade GPU cloud.

The collaboration between IO and Aethir aims to meet the demand for the rapidly growing GPU compute space, a market projected to quadruple in size by the end of the decade.

📌 Value Proposition and Market outlook

$IO has performed well so far since launch. The coin is well-distributed, with a lack of new supply unlocking (aka selling pressure) from the team for at least a year. Any new supply / unlocks are mostly from community rewards.

📌 $IO Mkt Snapshot (as of 6/18/24)

Price: ~3.77$

Current supply: ~95b

Total supply: ~800m

Mkt cap / FDV: 358m$ / 3.01b$

AETHIR ($ATH) ✨

Building the largest decentralized GPU cloud infrastructure in the world

💎 Sector: Compute Network/Cloud GPU

💎 Ticker: $ATH

👉 Do I own it?: I have Aethir nodes

✔️ Cloud / GPU Pick📌 A Cloud / GPU Giant in the Making

Aethir is a clear leader in the decentralized GPU cloud space. They have:

~20x more GPU’s than RNDR Network

~45x more TFLOPS / compute power than Akash ($AKT)

~31x more infrastructure capital committed than both $AKT and Render combined, impressive to say the least

📌 Strong Partnership with BEAM (Merit Circle)

Merit Circle ($BEAM) participated in the seed round for Aethir with $1,500,000 back in August 2023, marking the first step in their collaboration.

They have both publicly expressed an intent to work closely together over the coming years, building a bridge between both the $BEAM ecosystem and Aethir’s already existing first-in-class infrastructure. Potential applications could include Gaming and Artificial Intelligence - As games continue to increase in complexity and reliance on AI, the Cloud offers an attractive outlet to source this additional power, especially for on demand and real-time streaming.

📌 Market Performance since TGE and outlook

$ATH is currently valued at 0.07$, with a market cap around .25b$, and an FDV of about 3B$. The chart is early but looks promising, and could potentially be putting in a floor price to springboard.

Aethir was immediately listed on many top tier 1 exchanges and currently trades around the same FDV as its last raise (3b$). Although it’s difficult to speculate in the shorter term, longer term, it would not surprise me if this one ends up in multi-billions FDV (5b-10b+), if this cycle’s trend of AI / GPU outperformance continues.

It makes sense that $ATH, being at the forefront of AI and GPU capability, would warrant such a lofty valuation, considering many of the top AI plays currently tradeable have FDVs measured in the multiple billion$ ($NEAR @ ~7B, $RNDR ~5B, etc). I do think many of the top AI projects in the DePIN sector have a solid chance of reaching 10s of B$ (again, as measured by FDV) whenever the next cycle top arrives (my best guess is sometime in 2025). NOT FINANCIAL ADVICE - just my best guess. I’m just a godel on the internet.

📌 $ATH Market Snapshot (as of 6/18/24)

Price: ~0.07$

Current supply: ~3.78b

Total supply: ~42b

Mkt cap / FDV: 264m$ / 2.93b$

SOPHON ($SOPH) ✨

A blockchain built on zkSync and ____, focused on entertainment, gaming & ai

💎 Sector: Compute Network

💎 Ticker: $SOPH

👉 Do I own it?: Participated in node sale & will farm $SOPH

✔️ Dark Horse Pick📌 The growing need for compute - Filling the AI / Entertainment niche

Sophon ($SOPH) has high potential of becoming another multi-Billion $ giant in the AI, gaming, & entertainment space. As an infrastructure player backed by partners with over 500m$ in net treasury, it’s set to disrupt the incumbent AI and distributed compute landscape.

This growing need for computing power is driven primarily by 5 categories:

Artificial Intelligence (incl Large language models like chat GPT)

Autonomous Vehicles

Advanced Drug Development

Next - Gen Gaming / Streaming (i.e entertainment) **

Edge Computing

Not as much is known about Sophon as compared to many of the other players on this list (mostly due to it being quite a bit newer), however this can work in our favor by remaining largely unknown / undervalued.

📌 Value proposition, niche, and the AI revolution

If you follow the logic that AI might eventually free up quite a bit of labor force, then it follows that that labor force that might have otherwise been working would have to occupy their time with other tasks (be it workplace re-training, hobbies, or entertainment - the niche Sophon seeks to target). If we reach a certain nexus in society where AI automates faster than the broad workforces’ ability to re-train for new positions, or if the future looks more and more machine / automation heavy vs human capital centric, it’s reasonable to assume that the entertainment segment could stand to continue to increase in size, as people would need something to occupy their newfound idle time with.

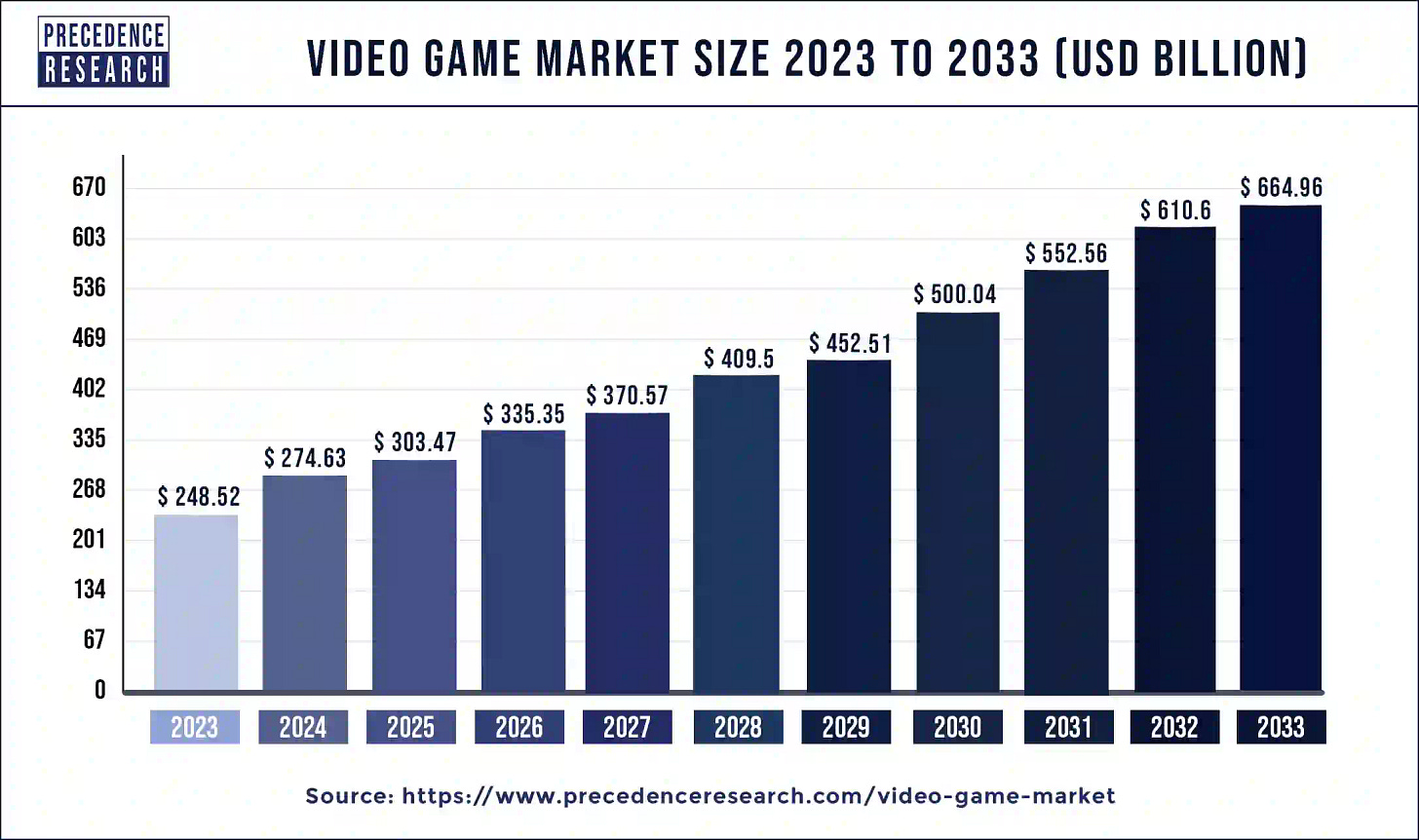

According to an article by fortune business insights the global gaming market was valued at 249.55 billion$ in 2022 & is anticipated to grow from 281.77$ billion in 2023 to 665.77$ billion by 2030. An increase in size by more than 100% by the end of the decade.

Another research piece by Precedence Research shows the video game market ballooning to 500 billion$ by 2030, and 664 billion$ by 2033 (a similar figure as fortune, but a few years later). If either projection is in the ballpark of reality, targeting an entertainment segment including gaming as one component, along with others, is a large addressable total market with high upside, to say the very least.

The above is why I remain highly bullish on gaming itself into the future as well as the broader umbrella of ‘entertainment’, and view web3/blockchain gaming as simply the next iteration of value-add to gaming as a whole, as online & mobile was a value add to gaming prior, and digital/electronic gaming to strictly non-electronic before it and so on.

📌 Standing on the shoulders of giants

Sophon has yet to reach TGE, and has already accumulated some impressive partners to say the least. The net assets of backed partners and collaborators by this blockchain currently stands at over 500m$. Some of these include:

Merit Circle / Beam

ZentryHQ

Aethir

Early participants in the Sophon node sale were able to secure nodes via a white list and public sale (60m$ raised). The implied FDV during these tiers was quite low compared to recent market entrants in the AI / GPU space, IO & ATH both command an FDV at or above 3B$ FDV for example. Many established players covered in this paper as well as others also command similarly large valuations.

While it remains to be seen what $SOPH will trade at, it remains one of my top projects of interest for the long term due to its strong target market in AI & Entertainment / Gaming, as well as large backers with strong financials.

📌 Sophon Farming Campaign and Airdrops

Participants in the SOPH farming campaign have the opportunity to stake certain assets to earn $SOPH as well as qualify for a $SOPH airdrop.

You are now able to farm the Sophon (+) blockchain’s token → $SOPH via BEAM, the only token currently announced for this program, and the only way to secure $SOPH if you missed the node sale at the end of April.

There is nothing specific on what the airdrops for the Sophon ecosystem will be nor when they will be dropped, however, a small hint can be seen on the main ‘X’ account. I suspect Sophon has a good chance of following Aethir’s lead (a key partner), with airdrops for farmers and node holders in the future.

I will revisit this in the future.

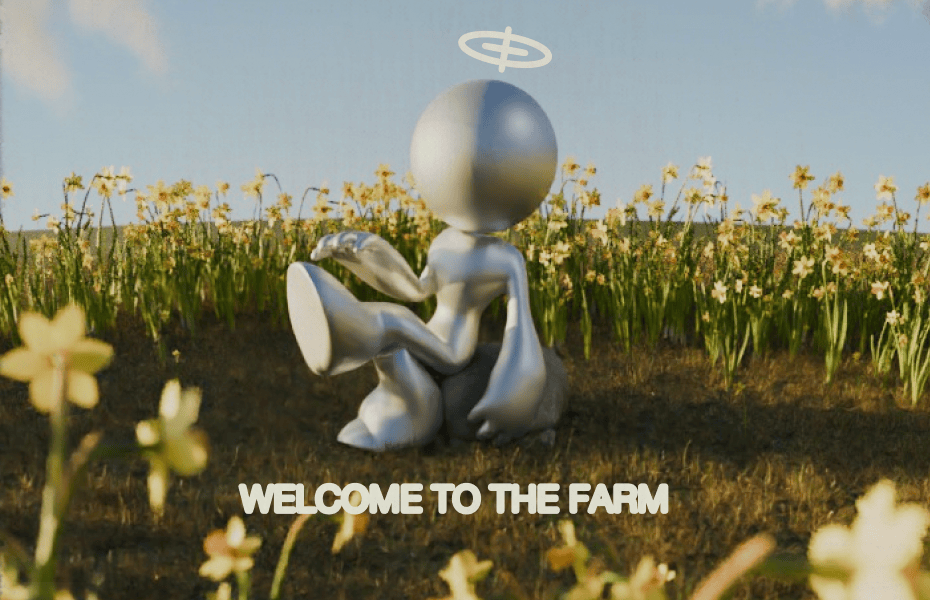

BEAM ✨

The leading Gaming, AI, Infrastructure, Gambling & Everything powerhouse

💎 Sector: Gaming/AI/Infrastructure

💎 Ticker: $BEAM

👉 Do I own it?: Yes

✔️ Overall Pick📌 Focus on AI / GPU / DePIN in addition to Gaming

Staring primarily as a Gaming focused DAO, BEAM has continued to spread its focus to involve a heavy emphasis in both AI and DePIN. It’s easy to see why, AI continues to play a bigger role in games, both from a ‘fun factor’ aspect for gamers - think smarter enemies, enhanced replayability, and better level design via generative AI - as well as from the development process aspect itself.

Cloud Gaming / Streaming will continue to become especially important or many next-gen web3 enabled games of the future as many will leverage the Cloud for any number their critical components, from delivery all the way through real-time streaming and processing. The best games of the future will leverage the power of the cloud vs a local model.

📌 Collaborations and Partnerships in AI & Cloud GPU

Merit Circle’s (DAO behind BEAM, 200m$ in non-native assets) more recent partnerships and strong collaborations in the AI / GPU space has solidified its spot as a top player.

Specific of note is Merit Circle’s purchase of 10m$ worth of Aethir nodes during their recent node sale. This follows on the tail of an initial investment of over 1.5m$ and strong partnership / collaboration with Aethir.

Holding beam grants you exposure to Aethir ($ATH) via its treasury, in addition to a myriad of other promising gaming, ai, infrastructure, gambling players. Beam in and of itself is a promising ecosystem and subnet in its own right, and has large ambitions for its future.

In addition to holding Beam, I intend on taking full advantage of its added utility to farm $SOPH (in addition to holding nodes), as well as continue to participate in its ecosystem in various ways.

📌 AI in Game Development

In addition to large forays in the GPU and Cloud space, Merit Circle is also making in-roads to AI in game development via key investments such as Xterio games, whose goal is to scale Web3 gaming via tooling that leverages AI in game development.

Xterio’s proprietary back & front-end solution seeks to integrate ownership of on-chain assets seamlessly across a multitude of platforms including mobile and desktop.

In addition to exciting developments in the AI / GPU & DePIN arena, the ecosystem continues to grow and evolve, seeing many developments and partnerships in both games and infrastructure, internally via Beam (Buildonbeam) itself as well as externally.

Trial Xtreme - Building the first web3 competitive games in a decentralized ecosystem. Experienced web2 team with many successful titles achieving high daily active user counts in Web 2 as well as Web 3 early builds.

Forgotten Playland - Free-to-Play social ‘Web3 meets Mario party’ experience utilizing cosmetics with a myriad of mini games and customizations.

Saga - Building configurable & scalable blockchain infrastructure at low-cost

Berachain - Proof of Liquidity L1 that aims to turn liquidity into security

Toncoin - 854 apps and Powered via the The Open Network (TON)

Azuro - On-chain composable prediction & betting mkt

📌 Treasury → Revenue → Price

When we look at the current day crypto market, one thing stands out very clearly - few projects earn an actual revenue. Beyond revenue, even fewer still earn a profit (derived from revenue - cost). Beam is one of the few projects that is not only in the green, it also commands one of the largest treasuries in crypto (200m$ and growing). This makes it a relatively lower risk bet vs many others in the Gaming/AI/Infra space, as most projections for future growth would be based off of some multiple vs treasury.

We can imagine a scenario whereby the DAO achieves multiple hundred million$ in ROI via strategic investments over the next 1-2 yrs, and a figure in the multiple billion$ in ROI over the next 5+ yrs, with that revenue flowing right back to $BEAM. I believe this scenario will happen over the next years and remains the reason why BEAM is my #1 holding.

You can track the effect of buys and burns on the BEAM supply by visiting the burnbeam app, built by community member @sub_research.

In total:

37,649,325,002 BEAM tokens have been ‘burnt’ and will never re-enter supply.

The combined value of all tokens at the time of burning totaled $326,529,890.

37.6% of supply has been burnt over 76 burns.

The average burn price: $0.0087 per BEAM.

📌 Overall value proposition of BEAM

$BEAM as exposure to 'everything' - Already an established leader in Gaming, and now increasingly AI, Gambling, SocialFi as well as others.

MIP-7 - Ensures constant demand pressures on the native token as the treasury performs positively (net positive revenue fed back in the form of token burns/buys). Latest Treasury Report | Merit Circle Treasury Dash

Utility - Holders of BEAM will be able to ‘farm’ SOPH (Sophon) tokens this month (the only token so far announced). This effectively grants holders of BEAM ‘free’ tokens by putting them to use in another promising AI / node player.

Airdrops - A list of addresses was recently posted via an RFP that seeks to reward active participants in the BEAM ecosystem. These contributors may be eligible to receive a part of the LayerZero community drop. Criteria for receiving includes being a BEAM bridge user, a token holder on the BEAM subnet, an LP on BEAM swap, or a user with a history of voting on proposals.

📌 SOPH farming and its affect on BEAM supply/float

The introduction of Sophon farming via the BEAM token (enabled on June 18th), has the potential to significantly tie up a large portion of the available / tradeable BEAM supply for the length of the staking program (TBD). It’s hard to predict with specificity what effect this will have on price exactly, but it’s a fairly safe bet to imagine that the average supply floating around various DEX and exchanges will be reduced to a significant degree. This could potentially increase volatility on major price/demand swings, especially relevant in active bull markets.

In either case, this is certainly something BEAM holders should keep in their back pockets to be mindful of, and many holders will surely elect to participate in the program to net ‘free’ $SOPH.

📌 $BEAM Market Snapshot (as of 6/18/24)

Price: ~0.0173$

Current supply: ~49.4b

Total supply: ~62.4b

Mkt cap / FDV: 859m$ / 1.08b$

Additional Projects

Bittensor ($TAO) :-

Bandwidth Network incentivizing artificial intelligence via subnets

Gamifies research collaboration through crypto incentives

Transforms digital commodities (i.e compute, data, storage, predictions etc) into intelligence.

$TAO is used as the currency to facilitate intelligence in various subnets.

Helium ($HELIUM) :-

AI Services network operating on Solana disrupting wireless infrastructure.

Hotspots form a global wireless network and undertake 'Proof-of-Coverage'.

$HNT mining via radio vs GPUs.

Dynex ($DNX) :-

Leverages a unique neuromorphic quantum computing cloud for processing, accelerating processing speed & reducing cost.

$DNX is used to pay for computations.

QUBIC ($QUBIC) :-

Layer 1 network working towards ‘True AI’ via True Finality and high speed smart contract execution.

BalanceAI ($BAI) :-

Open-source incentivized AI Models Marketplace.

♐ Key Takeaways …

People naturally think in linear terms, exponential seems slow at first and then ‘speeds’ up at the end - Orgs & consumers alike will need to adjust to account for the new realities of a primarily AI-driven economy.

In accordance with exponential growth, organizations and people within must find creative ways to control costs to achieving continued AI growth / compute, as well as improved efficiencies toward.

DePIN leveraging GPUs / Cloud models are well suited to accommodate the demand and growth of AI due to the unique incentivization structures inherent within them, and it is beginning to be reflected in the valuations of many promising players in this sector of crypto, but it is still early (hence opportunity).

Opportunities exist in the AI / DePIN space due to valuation inefficiencies between traditional mkts and crypto; expect these inefficiencies to get filled as capital seeks a home from overvalued to undervalued.

Many factors such as the Global liquidity cycle, political factors in the west influencing sentiment, positive seasonality, as well as the current place in the long term growth trend of Bitcoin & crypto capitalization pointing to much higher valuations ahead in the next 1 - 1.5yrs.

Aethir, Sophon and Beam each have significant funding, partnerships, and expertise necessary to deliver disruptive innovation, compete and capture growth in this fast paced and highly competitive sector. I specifically like the teams behind these 3 projects and continue to prioritize investing in people first.

KG

Resources :

Kurzweil’s Law of Accelerating Returns : https://www.edge.org/response-detail/10600

Drivers of GPU growth : https://www.visualcapitalist.com/sp/5-drivers-behind-the-growth-of-the-gpu-cloud-computing-market/

The Global Liquidity Cycle : capitalwars.substack.com/p/the-global-liquidity-cycle

US “Net Liquidity” (May ‘24) : https://www.bentleyreid.com/charts-of-month/may/

Crypto / AI Mkt snapshot & Top Players (~30b) : https://www.coingecko.com/en/categories/artificial-intelligence

Crypto / DePIN Mkt snapshot : https://www.coingecko.com/en/categories/depin

AETHIR on X : https://x.com/AethirCloud

Aethir official blog : https://www.aethir.com/blog

Aethir + MC / BEAM Strong Collab : https://medium.com/@meritcircle/merit-circle-and-aethir-to-collaborate-on-bringing-distributed-gpu-cloud-infrastructure-to-the-beam-e703eea2b23a

Aethir Checker Node Sale Dynamics : https://docs.aethir.com/checker-nodes-explained/checker-node-sale-dynamics

ATH Token Utilities : https://www.aethir.com/blog-posts/ath-token-more-than-just-a-cryptocurrency

Aethir Airdrop Campaign - https://www.aethir.com/blog-posts/aethir-cloud-drop-an-airdrop-for-the-community

Aethir Checker Node Launch - https://blog.aethir.com/blog-posts/aethir-checker-nodes-launch-start-earning-rewards

Aethir Mainnet launch : https://cryptobriefing.com/aethir-mainnet-launch-gpu/

Aethir post-TGE journey : https://www.aethir.com/blog-posts/looking-forward-aethirs-post-tge-journey

Render Foundation : https://renderfoundation.com/

Render Network on X : https://x.com/rendernetwork

Render Network Knowledge Base : https://know.rendernetwork.com/

Render Network Medium : https://rendernetwork.medium.com/

Render Network Metrics Recap (2023) : https://medium.com/render-token/2023-render-network-metrics-recap-q4-btn-january-30th-2024-94e05b0b0c32

Akash Network : https://akash.network/

Akash Network on X : https://x.com/akashnet_

Akash Network Blog : https://akash.network/blog/

Akash Accelerate ‘24 - The Path Forward for Permissionless Compute : https://akash.network/blog/akash-accelerate-24-the-path-forward-for-permissionless-compute/

ATOR on X : https://x.com/atorprotocol

ATOR Protocol explained : https://medium.com/@ZeroSumTrayder/part-3-ator-protocol-next-years-32-billion-depin-privacy-monster-ad34eb0117de

IONET : https://io.net/

IONET on X : https://x.com/ionet

Exploring the Future of GPU Computing in Web3: A Comprehensive Analysis of io.net : https://www.houseofchimera.com/blog/blogposts/2024-05-24-research-paper-io-net/

Sophon on X : https://x.com/sophon

Sophon Explainer by SCC : https://x.com/sadcatcapital/status/1784568272219763138

Sophon Node Sale Dune Dash (completed) : https://dune.com/sohwak_archive/sophon-node-sales

Sophon 60m$ node sale : https://www.coindesk.com/tech/2024/05/08/its-not-a-token-offering-its-a-node-sale-sophon-blockchain-raises-60m/

Sophon Farming Campaign : farm.sophon.xyz

BEAM on X : https://twitter.com/BuildOnBeam

BEAM ‘OS’ : onbeam.com

MC Substack (updates, treas. rpts) : meritcircle.substack.com

Merit Circle on X : https://twitter.com/MeritCircle_IO

Merit Circle (BEAM) Treasury Dashboard : https://treasury.meritcircle.io/

Beam Real-Time Circulating Supply data feed : BEAM real-time circ. supply

BurnBeam Beam Burn Tracker App : BurnBeam.com

Bittensor on X : https://twitter.com/opentensor

Bittensor TAO explainer : https://bittensor.com/explained

Helium : https://linktr.ee/heliumnetwork

Qubic on X : https://x.com/_Qubic_

BalanceAI on X : https://x.com/Balanse_AI

Dynex on X : https://x.com/dynexcoin

Crypto Study Discord : https://discord.gg/htbCBfUBcS